現在お買い物カゴには何も入っていません。

Mater File Submission in Japan

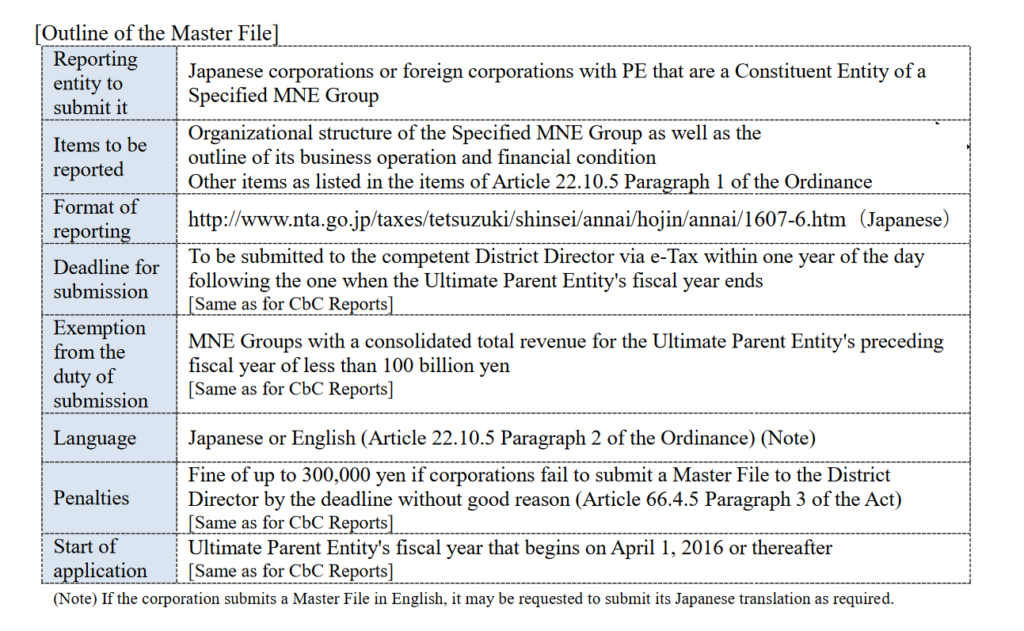

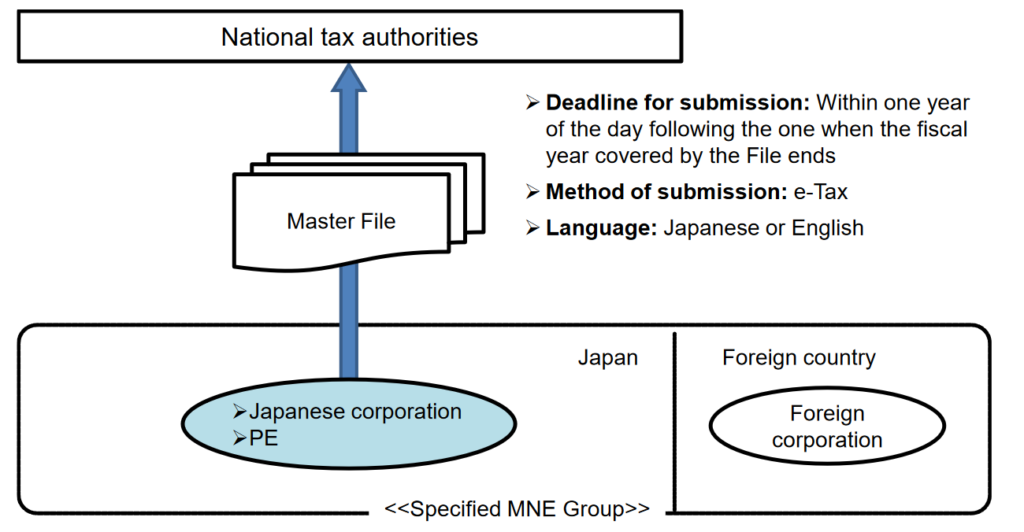

Japanese corporations or foreign corporations with PE that is a Constituent Entity of a Specified MNE Group must submit a Master File to the competent District Director via e-Tax within one year of the day following the one when the fiscal year covered by the File ends (Article 66.4.5 Paragraph 1 of the Act).

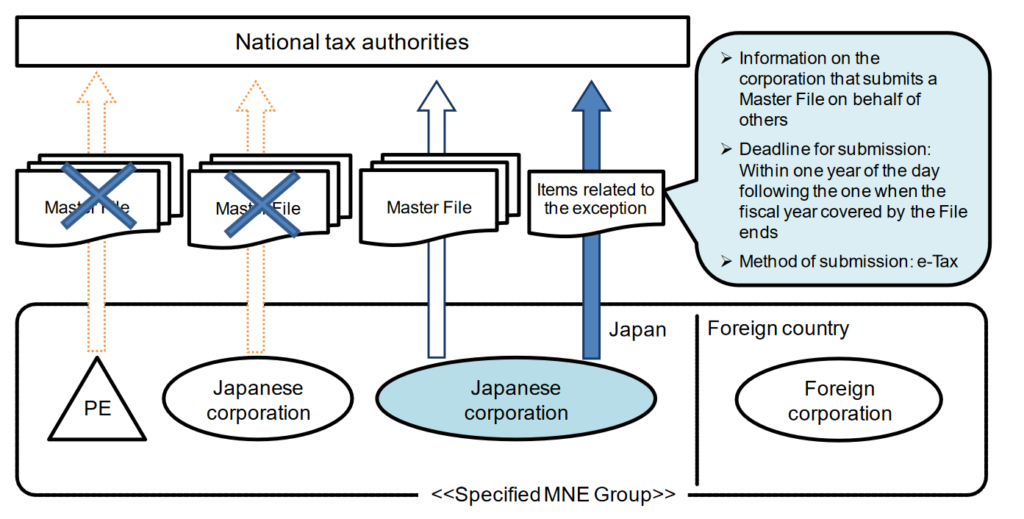

In principle, if there are several Japanese corporations or foreign corporations with PE that must submit a Master File, all of them have the duty to do so. But as an exception, if one of the corporations submits information (Note) on the corporations it represents when it submits a Master File to the competent District Director via e-Tax within one year of the day following the one when the fiscal year covered by the File ends, corporations other than the representative one do not need to submit a Master File (Article 66.4.5 Paragraph 2 of the Act).

(Note)

The major content of the information to be submitted is as follows (Article 22.10.5 Paragraph 3 of the Ordinance):

- Name of the corporation that submits a Master File on behalf of others, the location of its head and other offices, its corporate number, the name of its representative, etc.

- Names of corporations other than the one that submits a Master File on behalf of others, the location of their head and other offices, their corporate numbers, the names of their representative, etc.